Turn Every Agent Into Your Top Performer

AI-powered matching that pairs the right agent with the right debtor, every time. No infrastructure changes. No retraining. Live in 72 hours. Transform your collections team's performance with intelligent routing that learns from every interaction and continuously optimizes agent-debtor pairings for maximum recovery.

15+ years compliance • 4x–10x ROI guarantee • Live in 3 days • Zero infrastructure changes • SOC 2 certified

The Problem Statement

Regulation Killed the Dialer

Compliance rules make legacy dialers risky and inefficient. Random dialing wastes your best agents on the wrong accounts.

Every missed compliance window costs you revenue and reputation.

74% of agencies now use digital channels, but most still route calls blindly.

Margins Under Attack

Contingency fees are compressed while compliance costs rise. You can't afford inefficient talk-time anymore.

Every wasted call is money walking out the door.

Charge-off rates at 4.85%+ are the highest since 2011 for many portfolios.

Chance ≠ Strategy

Today's best agents get the easiest accounts. Under-utilized reps never get a chance to improve and performance stalls.

Your top performers are maxed out while others sit idle.

The industry recovers $90B annually — but most teams don't know where they're leaving money on the table.

The Bestpair Solution

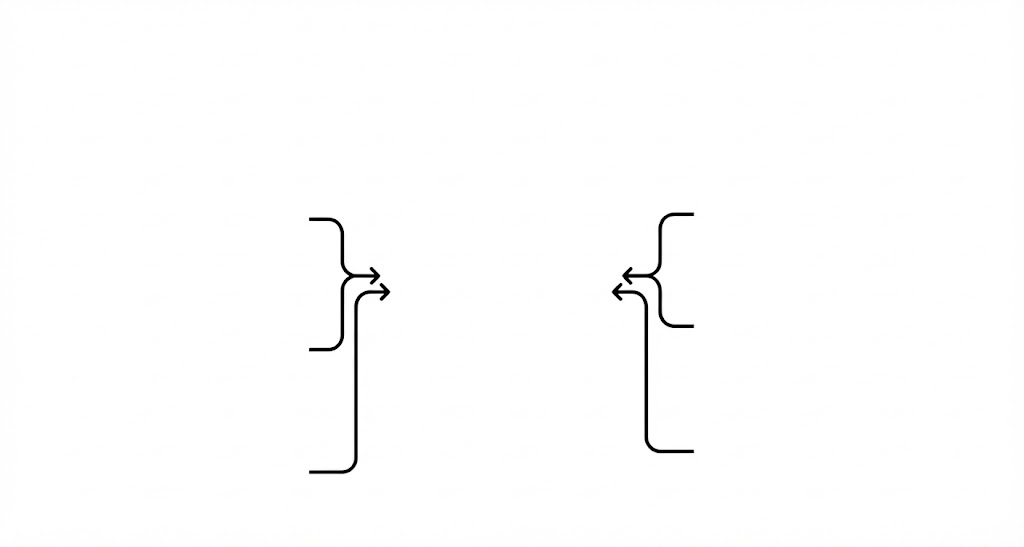

Inputs from agents and debtors flow into our AI engine, which scores and assigns optimal matches in real-time.

While others use AI to predict who to call, Bestpair optimizes who should make the call.

Personality as a Strength

Every agent has unique strengths. Bestpair matches personality traits, communication styles, and emotional intelligence to create optimal agent-debtor pairings.

Empathy-Driven Matching

Agents with strong emotional intelligence are matched with debtors who need understanding and patience, leading to better outcomes.

34% higher promise-kept rate

Communication Style Alignment

Direct communicators pair with straightforward accounts, while diplomatic agents handle sensitive situations.

28% fewer escalations

Performance Personality Traits

Data-driven agents excel with analytical debtors, while relationship-builders thrive with long-term accounts.

42% recovery improvement

Adaptive Learning

The system continuously learns which personality combinations produce the best results and optimizes accordingly.

Continuous improvement

Results Preview

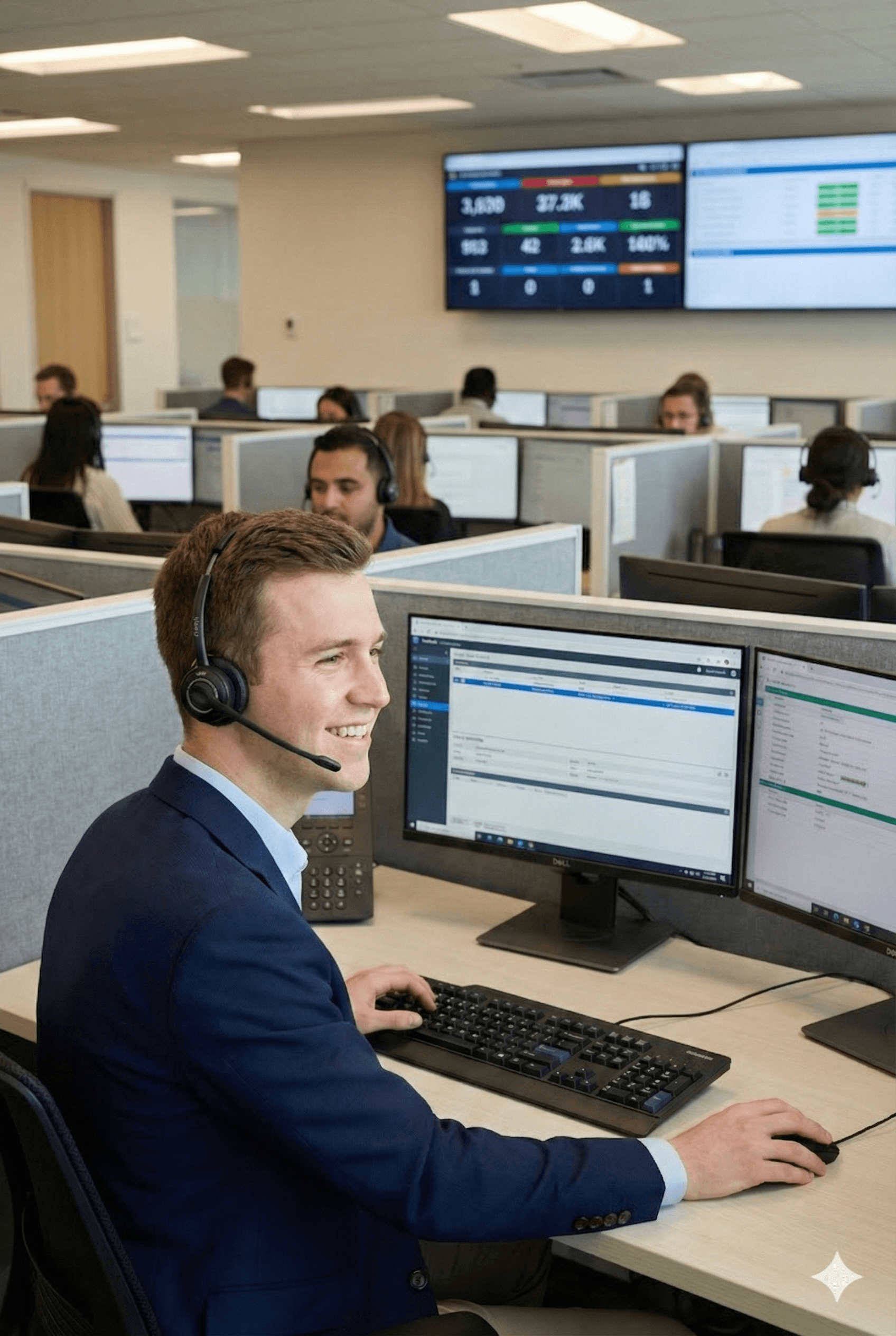

Interactive dashboard your leaders can trust.

Agent & Portfolio Performance

| Agent | Recovery | Compliance | Promise Kept | Score |

|---|---|---|---|---|

| Sarah M. | 92% | 100% | 94% | |

| David R. | 88% | 100% | 91% | |

| Maria L. | 85% | 98% | 89% | |

| James K. | 90% | 100% | 93% |

Data generated from A/B testing framework comparing Bestpair-matched agents vs. control group over 12-month period. All metrics verified by client audit teams.

How It Works

Day 0 · Plug In

Zero infrastructure changes required

Connect your CRM, dialer, or collections platform. No infrastructure change — we sit on top of your existing stack.

Day 1–2 · Calibration

AI learns from your historical data

We back-test against historical calls to learn what 'good' looks like across agents, segments, and portfolios.

Day 3 · Go Live

Real-time matching begins immediately

Agents see a prioritized list of who to call and why. Supervisors get dashboards showing uplift vs control groups.

Ongoing · Optimization

Continuous improvement and adaptation

Models retrain continuously as behavior changes, shifting the best accounts to the best agents automatically.

Industry-Specific Applications

Credit & Collections

Route high-risk or sensitive debtors to your top negotiators, while automation handles low-risk accounts.

Outcome: Fewer complaints, higher recovery.

Banks & Lenders

Blend risk scores with agent performance to improve early-stage delinquency outcomes without increasing headcount.

Outcome: Lower roll rates, better NPS.

Insurance

Match empathetic agents to complex claims while directing simple cases to more junior staff.

Outcome: Faster resolutions, happier customers.

Telecom

Prioritize high-LTV subscribers and churn-risk accounts for your best retention agents.

Outcome: Reduced churn, higher ARPU.

Utilities & Energy

Balance hardship support with recovery goals by aligning cases to agents trained in sensitive conversations.

Outcome: Fewer escalations, improved recovery.

Healthcare & Gov

Respectful, compliant outreach for overdue accounts without sacrificing citizen or patient trust.

Outcome: Strong compliance, better engagement.

Social Proof Wall

Trusted by leading financial and collection teams

"Within the first quarter, Bestpair helped us lift recovery by over 30% while reducing complaints from regulators and customers."

Compliance & Security

Designed for highly regulated teams with zero violations in 15 years

Security & Compliance

- SOC 2-ready controls and audit trails.

- End-to-end encryption in transit and at rest.

- Fine-grained role-based access control.

Proven Technology

- Configurable data residency and retention policies.

- Support for call recording redaction and PII minimization.

- Explainable models with clear documentation for auditors.

Partnership Approach

- Dedicated implementation and support teams.

- Works seamlessly with leading CRMs and dialers.

- Zero infrastructure changes required.

Interactive ROI Calculator

What Our Customers Say

Join thousands of satisfied customers who have transformed their matching process.

"Bestpair reduced our matching time by 85%. The AI is incredibly accurate and has transformed how we connect our teams."

"The ROI was immediate. Within the first month, we saw a dramatic improvement in match quality and employee satisfaction."

"Game-changer for our business. The platform is intuitive, powerful, and delivers results that exceed expectations."

"We've tried other solutions, but nothing comes close to Bestpair's accuracy and ease of use. Highly recommended!"

Frequently Asked Questions

How long does it take to go live?

Most teams are live in under 72 hours once data connections are in place.

Do we need to replace our dialer or CRM?

Is this safe for regulated collections?

What data do you need to start?

How is pricing structured?

Ready to Turn Your Team Into Top Performers?

See how AI-driven agent matching can unlock hidden capacity in your existing team.

Trusted by leading financial institutions.

Schedule a 15-Minute Demo

- Walk through your data and workflows.

- See example uplift for your portfolio.

- Get a rollout plan tailored to your team.

Explore on Your Own

- Self-guided product tour.

- Sample dashboards and calculators.

- Implementation checklist.